GST Rate Revised by lowering tax rates on 213 items

By MYBRANDBOOK

To make GST affordable, friendly Modi government has revised on certain goods like Detergent, marble floorings, toiletries are among items shifted to the 18% tax bracket from 28%. Out of 228 items in the 28% tax bracket, 178 have been put into the lower tax category of 18%, Finance Minister Arun Jaitley announced at a press briefing after the GST Council meet in Guwahati on Friday.

The modified rates will come into force on November 15. Mr. Jaitley said. Six items to go from 5% to Zero tax.

The tax rate on two items have been reduced from 28% to 12%, 13 items have been reduced from 18% to 12%, while the rate on six items have been cut from 18% to 5% and that of eight items from 12% to 5%. Six items have gone from 5% to zero, Mr. Jaitley announced.

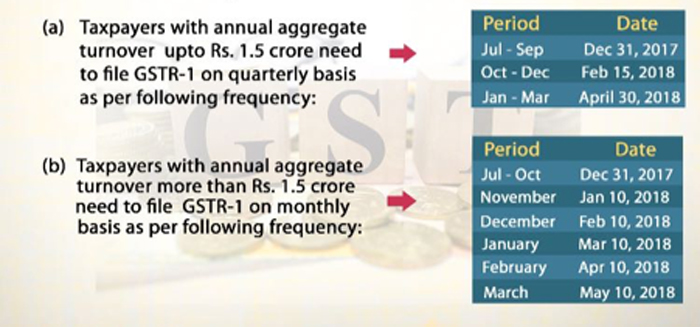

Recommendations by GST Council in the 23rd meeting at Guwahati, is filling of returns has further simplified with the the time period for filing GSTR -2 and GSTR-3 for July,2017 to March 2018 would be worked out by a committee of officers. However,filing of GSTR-1 will continue for the entire period without requiring of GSTR-2 & GSTR-3 for the previous month/period.

Secondly,All taxpayers would file return in FORM GSTR-3B along with payment of Tax,by 20th of the succeeding month till march,2018.

For filing of details in FORM GSTR-1 till March 2018,taxpayers would be divided into two categories.

Prime Minister Narendra Modi said, the GST has become "even simpler" after GST Council's recommendations and that it is in line with the government's constant endeavor to safeguard citizens' interests and ensure India's economy grows and by describing GST as 'Good and Simple Tax'.

"Good and Simple Tax (GST) becomes even simpler. Today's recommendations will immensely help small and medium business," the prime minister said in a tweet.

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

ICONS OF INDIA : SANJAY GUPTA

Sanjay Gupta is the Country Head and Vice President of Google India an...

Icons Of India : Anil Kumar Lahoti

Anil Kumar Lahoti, Chairman, Telecom Regulatory Authority of India (TR...

Icons Of India : NANDAN NILEKANI

Nandan Nilekani is the Co-Founder and Chairman of Infosys Technologies...

ECIL - Electronics Corporation of India Limited

ECIL is distinguished by its diverse technological capabilities and it...

NIC - National Informatics Centre

NIC serves as the primary IT solutions provider for the government of ...

STPI - Software Technology Parks of India

STPI promotes and facilitates the growth of the IT and ITES industry i...

Indian Tech Talent Excelling The Tech World - RAVI KUMAR S, CEO- Cognizant

Ravi Kumar S, appointed as CEO of Cognizant in January 2023, sets the ...

Indian Tech Talent Excelling The Tech World - Steve Sanghi, Executive Chair, Microchip

Steve Sanghi, the Executive Chair of Microchip Technology, has been a ...

Indian Tech Talent Excelling The Tech World - Aman Bhutani, CEO, GoDaddy

Aman Bhutani, the self-taught techie and CEO of GoDaddy, oversees a co...