Card payments in Hong Kong to register subdued growth of 1.2% in 2020

By MYBRANDBOOK

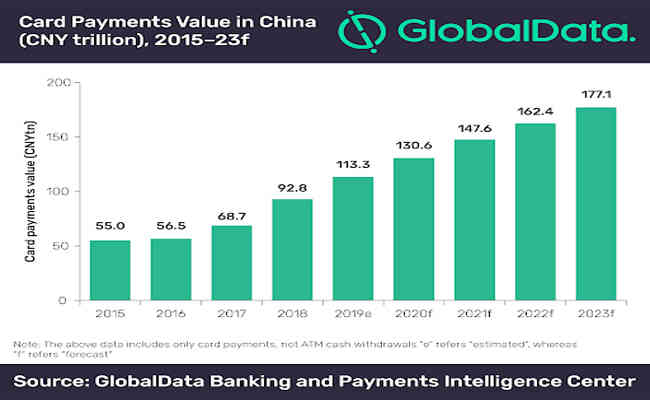

The lockdown and social distancing measures in Hong Kong due to COVID-19 has resulted in the closure of businesses and decline in consumer spending. As a result, card payments are estimated to register a subdued 1.2% growth this year, forecasts GlobalData, a leading data and analytics company.

As per the report, card payments market is expected to revive in the coming months with gradual reopening of businesses, easing of travel restrictions and potential launch of COVID-19 vaccine. The value of card payments is expected to increase at a compound annual growth rate (CAGR) of 3.9% between 2020 and 2024 to reach HK$1,241.7bn (US$159.4bn) in 2024.

Nikhil Reddy, Banking and Payments Analyst at GlobalData, comments: “The global trade war followed by Hong Kong protests (also known as anti-extradition law movement) affected the country’s economy, a situation which further worsened by the COVID-19 crisis. The downturn in economic growth has affected consumers’ buying capacity and subsequently impacted card payment.”

Credit cards is the most affected of all the card types. According to the Hong Kong Monetary Authority, credit card transaction value (including card payments at POS and cash withdrawals) registered a 11% decline in Q1 2020 compared to previous quarter. Debit cards, on the other hand, saw marginal rise of 0.9% during the same period.

According to GlobalData’s 2020 Banking & Payments Survey*, while card payments have declined in Q1 2020*, there is a rise in contactless card payments. To encourage contactless payments, the government introduced subsidy scheme for merchants in October 2020. Under this scheme, a subsidy of HK$5,000 (US$641.93) is offered to merchants to cover the cost of setting up contactless terminals and maintenance fees.

Mr Reddy concludes: “Hong Kong has a well-developed card payment market and strong payment infrastructure. While the current COVID-19 has caused a slowdown in its growth in 2020, it simultaneously brought major change in consumer preference towards non-cash tools such as contactless cards, which will in turn support card payments growth over the next few years.”

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

Icons Of India : NATARAJAN CHANDRASEKARAN

Natarajan Chandrasekaran (Chandra) is the Chairman of Tata Sons, the h...

ICONS OF INDIA : SOM SATSANGI

With more than three decades in the IT Sector, Som is responsible for ...

Icons Of India : Kumar Mangalam Birla

Aditya Birla Group chairman Kumar Mangalam Birla recently made a comeb...

RailTel Corporation of India Limited

RailTel is a leading telecommunications infrastructure provider in Ind...

BSE - Bombay Stock Exchange

The Bombay Stock Exchange (BSE) is one of India’s largest and oldest...

C-DOT - Center of Development of Telematics

India’s premier research and development center focused on telecommu...

Indian Tech Talent Excelling The Tech World - Steve Sanghi, Executive Chair, Microchip

Steve Sanghi, the Executive Chair of Microchip Technology, has been a ...

Indian Tech Talent Excelling The Tech World - Lal Karsanbhai, President & CEO, Emerson

Lal Karsanbhai, President and CEO of Emerson, assumed the leadership i...

Indian Tech Talent Excelling The Tech World - Aman Bhutani, CEO, GoDaddy

Aman Bhutani, the self-taught techie and CEO of GoDaddy, oversees a co...