NPCI Announces UPI Safety and Awareness Week & Month

By MYBRANDBOOK

With an aim to create awareness amongst consumers, National Payments Corporation of India (NPCI) and the UPI ecosystem have announced the UPI Safety and Awareness initiative. NPCI and the ecosystem comprising of leading banks and fintechs will observe February 1-7 as ‘UPI Safety and Awareness Week’ and the whole of February as ‘UPI Safety and Awareness Month’.

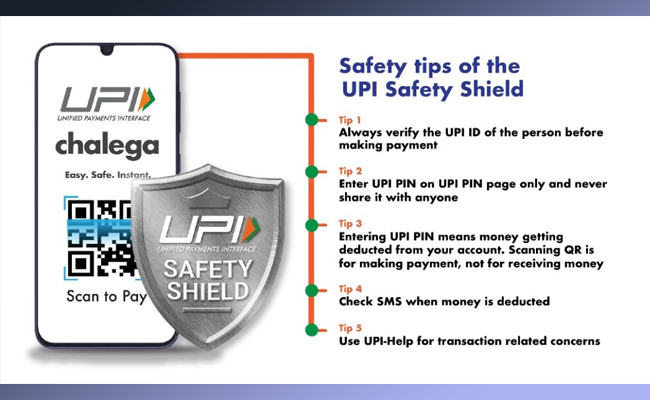

Under this programme, NPCI urges all the customers to follow the concept of UPI Safety Shield, which the company has derived to educate customers all about UPI payments. The UPI Safety and Awareness initiative will help vulnerable and first-time customers in overcoming their fears of adopting digital payments and guide them to pursue safe payments on the UPI platform. The safety awareness initiative which will run continuously shall pave the way to make India a less-cash society as per the vision of Government of India and Reserve Bank of India. It will aid the journey of onboarding the next 300 Mn users on digital payments and processing Billion transactions a day on UPI platform over the next 3 to 5 years.

Reserve Bank of India(RBI) has also recently cautioned members of public against unscrupulous elements that are defrauding and urged the public to practice safe digital payments by taking all due precautions while carrying out financial transactions.

Dilip Asbe, MD & CEO, NPCI said, “We are pleased to announce February 1-7 and February as UPI Safety and Awareness Week and Month. We believe vigilance and digital literacy are our strongest defenses to fight cyber fraud. To continue Government of India and RBI’s vision of the less-cash economy, NPCI aims to take UPI to the last mile customers in the hinterlands of the country. We foresee onboarding over 300 million new UPI customers and processing a billion transactions a day on UPI platform in the next few years. We are confident that UPI Safety and Awareness initiative will make the customers ready to confidently tread into the unique ecosystem of digital payments and experience seamless digital transactions like never before.”

With UPI scaling new records month-on-month in terms of transaction volume and value along with various unique functionalities such as UPI AUTOPAY and IPO via UPI, it is important to make users aware of the safe usage of UPI. UPI is fully safe and secure unless user shares the confidential details or initiates the payment transaction using two-factor authentication unknowingly. Cybercriminals use fear and lack of knowledge to deceive vulnerable consumers by means like lottery, lucrative emails, fraud calls & messages, etc. While the UPI platform provides a safe and secure environment to keep the money safe, it also places immense power in the hands of its users. This strategic industry-wide initiative will help make consumers more careful and attentive while performing digital payments and pave the way for next stage of growth of digital payments - which is the need of the hour in the current times.

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

Icons Of India : Harsh Jain

Harsh Jain, the co-founder of Dream 11, the largest fantasy sports web...

Icons Of India : Deepak Sharma

Deepak Sharma spearheads Schneider Electric India. He brings with him ...

ICONS OF INDIA : SUNIL BHARTI MITTAL

Sunil Bharti Mittal is the Founder and Chairman of Bharti Enterprises,...

BEL - Bharat Electronics Limited

BEL is an Indian Government-owned aerospace and defence electronics co...

NIC - National Informatics Centre

NIC serves as the primary IT solutions provider for the government of ...

TCIL - Telecommunications Consultants India Limited

TCIL is a government-owned engineering and consultancy company...

Indian Tech Talent Excelling The Tech World - JAYASHREE ULLAL, President and CEO - Arista Network

Jayshree V. Ullal is a British-American billionaire businesswoman, ser...

Indian Tech Talent Excelling The Tech World - Satya Nadella, Chairman & CEO- Microsoft

Satya Nadella, the Chairman and CEO of Microsoft, recently emphasized ...

Indian Tech Talent Excelling The Tech World - Rajiv Ramaswami, President & CEO, Nutanix Technologies

Rajiv Ramaswami, President and CEO of Nutanix, brings over 30 years of...