Singapore to remove One-Time Passwords from Bank Accounts

By MYBRANDBOOK

According to the Monetary Authority of Singapore, clients who utilise secure digital tokens for identity authentication would no longer need to provide a one-time password to access their bank accounts for the next three months. It is highly recommended that online banking users activate digital tokens for their banking accounts so that they can access their bank accounts via a web browser or mobile app without having to rely on automatically generated, one-time passwords.

The announcement followed the Singapore Police issuing a warning about the reemergence of phishing scams that involved scammers impersonating banks to make victims divulge their banking account usernames, passwords and one-time passwords. In December, scammers defrauded 103 people in Singapore out of at least S$161,000.

The problem appears to be growing. In the first two weeks of January, scammers defrauded 219 people out of at least S$446,000. Many of these attacks involved scammers impersonating banks in SMS messages in which they directed users to click on links to verify their identities or cancel phony transactions.

President of Singapore Tharman Shanmugaratnam, who served as the chairman of the Monetary Authority of Singapore till July 2023, told Parliament shortly before stepping down from the post last year that the financial authority would set a deadline for phasing out one-time passwords as a sole authentication factor for high-risk transactions.

He said Singapore banks had already started phasing out SMS-based authentication for banking activities such as adding payees or changing fund transfer limits. Shanmugaratnam, however, ruled out giving banking users the option to opt out of SMS OTPs, warning that such a move could dilute banks' multilayered security for protecting customers.

The monetary authority in its announcement said that unlike one-time passwords, scammers cannot phish for customers' digital tokens by setting up fake bank websites, nor can they access a bank account or funds without the customer's explicit authorization.

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

SHAKTIKANTA DAS

Shaktikanta Das is serving as the current & 25th governor of the Reser...

Icons Of India : NATARAJAN CHANDRASEKARAN

Natarajan Chandrasekaran (Chandra) is the Chairman of Tata Sons, the h...

ICONS OF INDIA : RAMESH NATRAJAN

Ramesh Natarajan, CEO of Redington Limited, on overcoming ‘technolog...

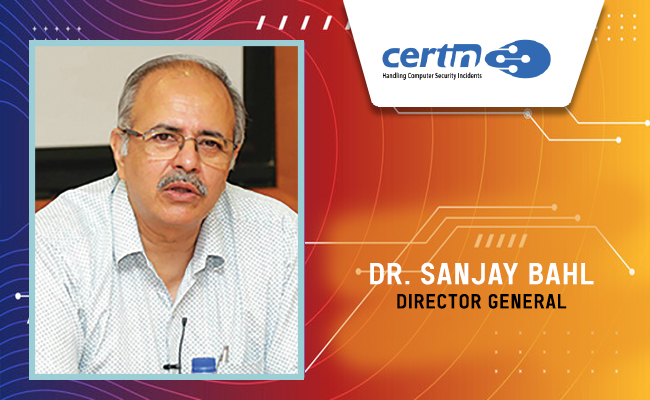

CERT-IN - Indian Computer Emergency Response Team

CERT-In is a national nodal agency for responding to computer security...

LIC - Life Insurance Corporation of India

LIC is the largest state-owned life insurance company in India...

TCIL - Telecommunications Consultants India Limited

TCIL is a government-owned engineering and consultancy company...

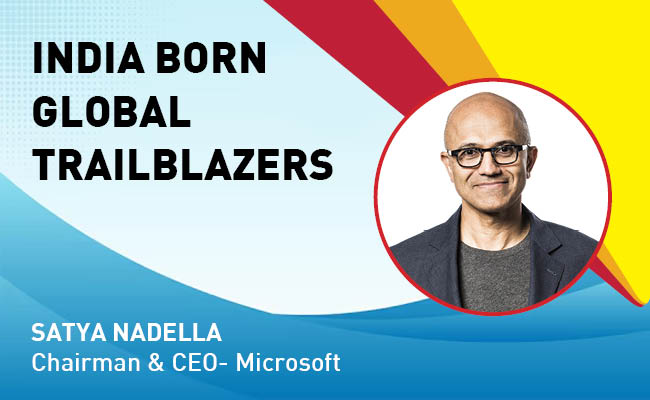

Indian Tech Talent Excelling The Tech World - Satya Nadella, Chairman & CEO- Microsoft

Satya Nadella, the Chairman and CEO of Microsoft, recently emphasized ...

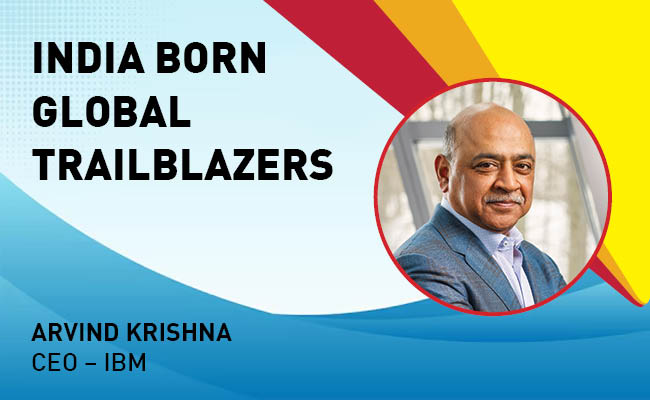

Indian Tech Talent Excelling The Tech World - ARVIND KRISHNA, CEO – IBM

Arvind Krishna, an Indian-American business executive, serves as the C...

Indian Tech Talent Excelling The Tech World - Vinod Dham, Founder & Executive Managing Partner, IndoUS Venture Partners

Vinod Dham, known as the “Father of the Pentium Chip,” has left an...