Desi approach to Digital Economy from CHALTA HAI to BADAL SAKTA HAI attitude

By MYBRANDBOOK

Addressing the CII Conference on Digital & Cashless Economy,where the Future of India’s Digital Payments and Cashless Economy” book was released during the conference, Shri Anurag Singh Thakur, Hon’ble Minister of State for Finance & Corporate Affairs, Govt. of India mentioned that the Government has left CHALTA HAI and adopted BADAL SAKTA HAI attitude in every aspect of governance including promoting digital economy and stressed that this attitude shift has brought in a positive change towards developing digital economy.Shri Anurag Singh Thakur, Hon’ble Minister of State for Finance & Corporate Affairs, Govt. of India

Eminent speakers from the sector addressed delegates during the conference which was attended by over 150 delegates including senior level participation from e-commerce companies, digital and internet service providers, financial institutions, technology suppliers, telecom service providers a, infrastructure players etc. and users. The minister said, "We are ensuring that the advantages of technology are not restricted to a select few but should reach all the sections of the society", said Shri Thakur. The Hon’ble MoS requested industry to come out with ways for promoting cash less transactions in rural India especially fruits & vegetable mandis and Pashu Mandis.

In his welcome remarks, Mr Ashutosh Chadha, Conference Chairman and VP & Head South Asia Public Policy & Government Affairs, Mastercard said, “India's digital payments economy has accelerated over the past five years. The RBI and Government have envisioned that the next few years will be a crucial time for digital payments in the country. All stakeholders should come together to formulate the optimal policies, programs and implementation to ensure that the goals for a less cash India are met."

Mr Ajay Kaushik, CEO, Panacea Infosec, in his address said, "India's transition towards becoming a less cash economy will advance the country’s goal to transform into a digitally empowered nation. This movement will be furthered by The Smart Cities Mission which will encourage the integration of digital payments into the fabric of society. While several initiatives have enabled us to move towards digitization, the collective momentum from the Government, regulators and industry will provide the push towards realizing that goal.”

In his address, Mr Loney Antony, Vice Chairman, Hitachi Payment Services said, "The Digital Payments landscape in India is undergoing rapid transformations. As innovations in technology and policy drive the change forward, we must be mindful of inclusivity. We must ensure ease of adoption for merchants, SMEs and customers from all walks of life. The digital economy stands to change the way we conduct ourselves financially. We require the correct policy decisions to be adopted, so that the shift is streamlined."

Dr Rishi Mohan Bhatnagar, President Aeris Communications while addressing delegates said that “Digital India mission powered with IoT technology has now developed a mature ecosystem, which is driving innovative business models using technology for financing assets and cashless payment system.”

While analyzing the importance of digitization for India, Mr Ravi Rajagopalan, MD & CEO Empays Payment Systems India said, “Getting digitization right is an important path to ensuring India hits the $5 trillion mark in GDP in a couple of years and perhaps exceed it. To do so, India has to chart out its own path, taking people along without any coercion and getting user experience, product design, consumer safety and protection and system integrity right - and it must be one that integrates cash into the journey. Our belief is - digital cash helps digital behavior”

Mr Praveen Khandelwal, National Secretary General, CAIT said that there is need to empower the traders with technology as 130 crores Indian have traders as their point of contact and not the companies. The Government should come out with a scheme for incentivizing traders and consumers in terms of GST benefits or otherwise for promoting digital transactions.

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

Icons Of India : ALOK OHRIE

Alok Ohrie leads Dell Technologies’ India business, overseeing Sales...

Icons Of India : Debjani Ghosh

Debjani Ghosh is the President of the National Association of Software...

Icons Of India : NANDAN NILEKANI

Nandan Nilekani is the Co-Founder and Chairman of Infosys Technologies...

LIC - Life Insurance Corporation of India

LIC is the largest state-owned life insurance company in India...

IOCL - Indian Oil Corporation Ltd.

IOCL is India’s largest oil refining and marketing company ...

STPI - Software Technology Parks of India

STPI promotes and facilitates the growth of the IT and ITES industry i...

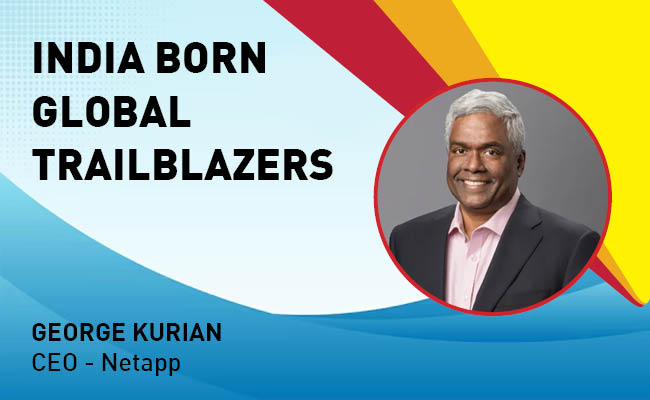

Indian Tech Talent Excelling The Tech World - George Kurian, CEO, Netapp

George Kurian, the CEO of global data storage and management services ...

Indian Tech Talent Excelling The Tech World - JAYASHREE ULLAL, President and CEO - Arista Network

Jayshree V. Ullal is a British-American billionaire businesswoman, ser...

Indian Tech Talent Excelling The Tech World - Dheeraj Pandey, CEO, DevRev

Dheeraj Pandey, Co-founder and CEO at DevRev , has a remarkable journe...