Is Alibaba’s Hong Kong listing turning the tables in favour of Asia’s unicorns?

By MYBRANDBOOK

For years, Asia’s hottest unicorns left their homelands to list in New York for one simple reason: a deep pool of U.S. money.

And they have been rewarded. From Alibaba Group Holding Ltd. to JD.com Inc., more than a dozen Chinese companies listed there have a market capitalization of $10 billion or more.

But Alibaba’s Hong Kong listing may be changing things. The e-commerce giant raised about $11 billion in the city’s largest issuance of stock since 2010, with about one-third of the tranche taken up by mainland Chinese fund managers. Other regional buyers were enthusiastic, too. Taiwan’s life insurer Fubon Financial Holding Co., for instance, placed a $500 million order.

This all goes to show that Asian investors are just as wealthy and eager as those in New York, which could go a long way toward making Hong Kong and Singapore more attractive listing venues. The region’s aging savers have amassed more than $10 trillion of wealth in the form of pension funds, mutual funds and insurance policies, HSBC Holdings Plc estimates.

With billions to deploy, Taiwan’s insurers and China’s mutual funds may find benefits to trading stocks in their own time zone, if only for their portfolio managers’ work-life balance.

Asia’s bustling IPO market also bodes well for the region’s restless unicorns, whose listing window in the U.S. is closing fast after a series of high-profile flops. If Americans can’t stomach Uber Technologies Inc., how will they have an appetite for Southeast Asian clones like Grab or Go-Jek? To make matters worse, U.S. investors have been pulling money out of emerging markets over the past several months. The MSCI Emerging Markets Index peaked in January 2018, while the S&P 500 Index continues to hit daily records.

There's one major caveat, however. Local investors can be a tough sell. Foreign money managers tend to think of Asia's biggest startups as a proxy for the macro scene, much in the same way that New York investors saw Alibaba as a bet on China's rising consumer class.

Domestic players, on the other hand, are living and breathing the macro picture, so they’re concerned primarily with company metrics. If you’re sitting in Jakarta traffic, you’re acutely aware of the challenges a ride-hailing company there faces; a foreign billionaire like Masayoshi Son just sees a thriving population with thousands of young, mobile-phone users.

Super-apps are another example. The region’s hottest unicorns like to pitch these all-in-one platforms to venture-capital investors. To improve operational efficiency, they argue, more cash is needed to expand regionally. But that business model relies on the assumption that the social-media habits of a 22-year-old Vietnamese wouldn’t be too different from an Indonesian’s. This might not fly with a local investor, who's more adept at discerning cultural differences.

Deeper local knowledge can also help avoid expensive mistakes. In October, Indian start-up Oyo Hotels and Homes raised $1.5 billion from SoftBank Group Corp., among other investors, as it looked to expand into foreign markets. Yet Chinese fund managers largely stayed away — and for good reason. This week, Reuters reported that Oyo is unlikely to hit profitability in India and China until 2022.

Similar reports had circulated in local Chinese media months ago, pointing out that the company had no traction on the mainland, even though it boasted of being the largest single hotel brand there. SoftBank’s Son may now have a tough time convincing investors in Hong Kong that Oyo is worth more than $10 billion, the valuation at its latest funding round.

In truth, Alibaba may not be the best test case to determine if Asia’s pool of money will slosh toward young companies. Within two business days, institutional investors can swap their Hong Kong-listed shares for stocks in New York, should they feel liquidity in the Asian city is thin. That option to flee to a U.S. haven may have brought hesitant investors on board in the first place.

As Asia’s unicorns grow bigger, many are looking at dual listings to ensure there’s enough demand to absorb their sizable offerings. Indonesia’s e-commerce platform Tokopedia PT, for instance, is considering a listing on multiple bourses as it seeks a pre-IPO funding round. This, to me, is a sign that Asia isn’t ready to be self-sufficient just yet. Saudi Arabia may be able to jam Aramco down local investors’ throats; but Asia’s startups are still stuck with a New York investor base that has a diminishing appetite for them.

(The article first appeared ET Retail.com and is authored by Shuli Ren)

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

ICONS OF INDIA : SANDIP PATEL

Sandip Patel is the Managing Director for IBM India & South Asia regio...

ICONS OF INDIA : SANTHOSH VISWANATHAN

Santhosh Viswanathan is the the Vice President and Managing Director f...

ICONS OF INDIA : RAMESH NATRAJAN

Ramesh Natarajan, CEO of Redington Limited, on overcoming ‘technolog...

IREDA - Indian Renewable Energy Development Agency Limited

IREDA is a specialized financial institution in India that facilitates...

ECIL - Electronics Corporation of India Limited

ECIL is distinguished by its diverse technological capabilities and it...

DRDO - Defence Research and Development Organisation

DRDO responsible for the development of technology for use by the mili...

Indian Tech Talent Excelling The Tech World - RAVI KUMAR S, CEO- Cognizant

Ravi Kumar S, appointed as CEO of Cognizant in January 2023, sets the ...

Indian Tech Talent Excelling The Tech World - REVATHI ADVAITHI, CEO- Flex

Revathi Advaithi, the CEO of Flex, is a dynamic leader driving growth ...

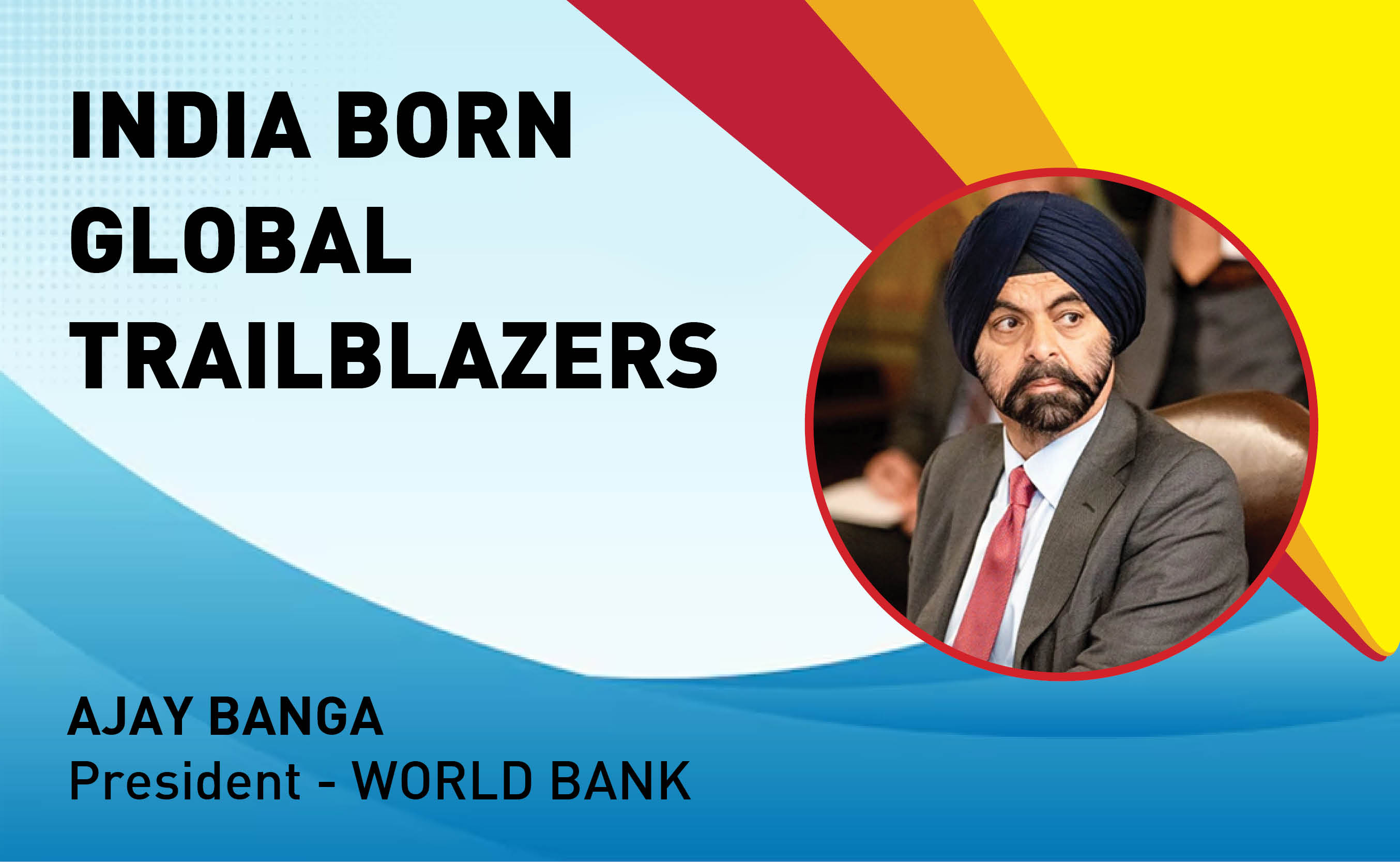

Indian Tech Talent Excelling The Tech World - AJAY BANGA, President - World Bank

Ajay Banga is an Indian-born American business executive who currently...