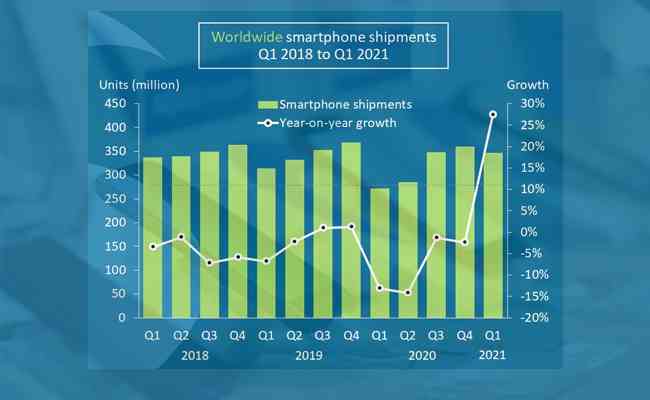

Worldwide smartphone market surges 27% as key regions subdue the pandemic

By MYBRANDBOOK

In Q1 2021, worldwide smartphone shipments reached 347 million units, up 27% year on year. Samsung took first place, shipping 76.5 million to take a 22% share. Apple shipped 52.4 million iPhones, to take a 15% share. Its iPhone 12 Mini has sold below expectations, but strength in other iPhone 12 models, as well as stronger demand for the older iPhone 11, helped it maintain strong momentum. Xiaomi clocked its best single-quarter performance ever, growing 62% and shipping 49.0 million units. Oppo and Vivo completed the top five, shipping 37.6 million units and 36.0 million units respectively. Huawei, which no longer includes Honor, is now in seventh place with 18.6 million units, as the former world number one remains shackled by US sanctions.

“Xiaomi is in pole position to be the new Huawei,” said Canalys Research Manager Ben Stanton. “In addition to great product value, it is now also making strides to recruit local talent, become more channel-friendly and lead in high-end innovation, as seen with the Mi 11 Ultra and its recent foldable, the Mi Mix Fold. Its competitors offer superior channel margin, but Xiaomi’s sheer volume actually gives distributors a better opportunity to make money than rival brands. But the race is not over. Oppo and Vivo are hot on its heels, and are positioning in the mid-range in many regions to box Xiaomi in at the low end. Honor is also a looming threat. It has already struck supply chain deals and is now signing distribution agreements to re-enter several markets in the second half of 2021. Xiaomi is leading the pack, but the race has only just started.”

“LG, a stalwart of the smartphone industry, is quitting this year,” said Canalys Analyst Sanyam Chaurasia. “It is symbolic of a new era in the smartphone market. It proves that aggressive pricing and channel strategy are more important than hardware differentiation in the modern day. LG holds the majority of its share in the Americas, at 80% of its total in 2020, which presents new opportunities for the likes of Motorola, TCL, Nokia and ZTE, particularly at price points below US$200. As the smartphone market continues to consolidate, this will not be the last time the incumbent vendors fight over the remains of a defeated brand.”

“COVID-19 is still a major consideration, but it is no longer the main bottleneck,” said Stanton. “Supply of critical components, such as chipsets, has quickly become a major concern, and will hinder smartphone shipments in the coming quarters. And it will drive global brands to rethink regional strategies. Some brands, for example, have de-prioritized device shipments in India, amid the new COVID-19 wave, and instead are focusing efforts on recovering regions, such as Europe. And while the shortages persist, it will grant larger companies a unique advantage, as the global brands have more power to negotiate allocation. This will put further pressure on smaller brands and could force many to follow LG out of the door.”

|

Worldwide smartphone shipments and growth Canalys Smartphone Market Pulse: Q1 2021 |

|||||

|

Vendor |

Q1 2021 shipments (million) |

Q1 2021 Market share |

Q1 2020 shipments (million) |

Q1 2020 Market share |

Annual |

|

Samsung |

76.5 |

22% |

59.6 |

22% |

+28% |

|

Apple |

52.4 |

15% |

37.1 |

14% |

+41% |

|

Xiaomi |

49.0 |

14% |

30.2 |

11% |

+62% |

|

Oppo |

37.6 |

11% |

23.5 |

9% |

+60% |

|

Vivo |

36.0 |

10% |

24.2 |

9% |

+48% |

|

Others |

95.9 |

28% |

97.8 |

36% |

-2% |

|

Total |

347.4 |

100.0% |

272.5 |

100.0% |

+27% |

|

Note: percentages may not add up to 100% due to rounding Source: Canalys estimates (sell-in shipments), Smartphone Analysis, April 2021 |

|||||

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

ICONS OF INDIA : S KRISHNAN

S Krishnan as the secretary for the electronics and information techno...

ICONS OF INDIA : RAMESH NATRAJAN

Ramesh Natarajan, CEO of Redington Limited, on overcoming ‘technolog...

Icons Of India : RAJENDRA SINGH PAWAR

Rajendra Singh Pawar is the Executive Chairman and Co-Founder of NIIT ...

UIDAI - Unique Identification Authority of India

UIDAI and the Aadhaar system represent a significant milestone in Indi...

HPCL - Hindustan Petroleum Corporation Ltd.

HPCL is an integrated oil and gas company involved in refining, market...

GSTN - Goods and Services Tax Network

GSTN provides shared IT infrastructure and service to both central and...

Indian Tech Talent Excelling The Tech World - REVATHI ADVAITHI, CEO- Flex

Revathi Advaithi, the CEO of Flex, is a dynamic leader driving growth ...

Indian Tech Talent Excelling The Tech World - Aneel Bhusri, CEO, Workday

Aneel Bhusri, Co-Founder and Executive Chair at Workday, has been a le...

Indian Tech Talent Excelling The Tech World - Sundar Pichai, CEO- Alphabet Inc.

Sundar Pichai, the CEO of Google and its parent company Alphabet Inc.,...