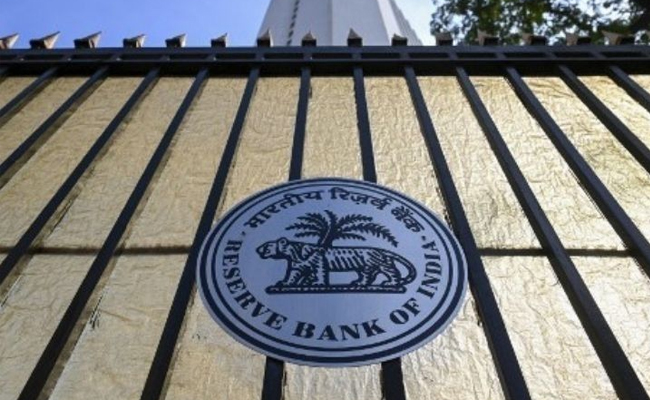

RBI to accept NBFCs' requests for bad-loan exemptions

By MYBRANDBOOK

The Central Bank of India is unlikely to give "shadow banks" exemptions from stricter bad-loan rules coming into force, essentially ending an advantage the non-bank financial firms have had over standard banks. Non-banking financial companies (NBFCs) have asked the Reserve Bank of India to exempt smaller loans from the rules taking effect next month that are in line with those covering banks.

As of March 2021, India had 10,000 shadow banks, the latest RBI data available, with assets of Rs 54 trillion ($680 billion) or about one-fourth that of the banking sector. Several of the biggest shadow banks are listed on the stock exchanges.

Under the new norms, shadow banks will have to recognise bad loans on a daily basis, rather than monthly, as some now do. Non-performing loans can only be upgraded to performing after borrowers have paid all arrears. Shadow banks wanted loans of up to Rs 2 crore ($250,000) to be exempt, and also asked for some accounting requirements to be relaxed and for an extension to comply with the new rules.

That could boost some institutions' bad loans high enough to subject them to additional regulatory requirements and force them to set aside more cash to provision against non-performing loans, industry executives say.

Shadow banks had also asked the RBI to lower the threshold on bad loans for which they would not need court approval to take control of securities pledged against the loan, manage or sell them to recover dues.

Arguing that their smaller average loan size puts them at a disadvantage to banks, the shadow banks in July sought this permission, under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest act, for loans over Rs 1 lakh ($1,250), compared with the current Rs 20 lakh.

Nazara and ONDC set to transform in-game monetization with ‘

Nazara Technologies has teamed up with the Open Network for Digital Comme...

Jio Platforms and NICSI to offer cloud services to government

In a collaborative initiative, the National Informatics Centre Services In...

BSNL awards ₹5,000 Cr Project to RVNL-Led Consortium

A syndicate led by Rail Vikas Nigam Limited (abbreviated as RVNL), along wi...

Pinterest tracks users without consent, alleges complaint

A recent complaint alleges that Pinterest, the popular image-sharing platf...

Icons Of India : AALOK KUMAR

Aalok Kumar is celebrated as a global leader and recipient of the Peop...

ICONS OF INDIA : VINAY SINHA

Vinay Sinha is the Managing Director of Sales for the India Mega Regio...

Icons Of India : Dr. Arvind Gupta

Arvind Gupta is the Head and Co-Founder of the Digital India Foundatio...

CERT-IN - Indian Computer Emergency Response Team

CERT-In is a national nodal agency for responding to computer security...

NIC - National Informatics Centre

NIC serves as the primary IT solutions provider for the government of ...

ECIL - Electronics Corporation of India Limited

ECIL is distinguished by its diverse technological capabilities and it...

Indian Tech Talent Excelling The Tech World - JAY CHAUDHRY, CEO – Zscaler

Jay Chaudhry, an Indian-American technology entrepreneur, is the CEO a...

Indian Tech Talent Excelling The Tech World - Thomas Kurian, CEO- Google Cloud

Thomas Kurian, the CEO of Google Cloud, has been instrumental in expan...

Indian Tech Talent Excelling The Tech World - Sundar Pichai, CEO- Alphabet Inc.

Sundar Pichai, the CEO of Google and its parent company Alphabet Inc.,...